Engagement & Retention project | Souled Store

Core Value Proposition

CVP for The Souled store is providing strong value offering in terms of Men, Women and Kids collection spread across:

- Top Wear

- Bottom Wear

- Accessories

- Special Street wear [Timed]

- Sneakers/Foot wear

- Special Collections (Hardik Pandya Cricket, Marvel, Peppa Pig etc.)

Along with these value offering, marrying collection with pricing, uniqueness/coolness/freshness of the collection with current time/requirements of the user ensuring stocks across channels would key CVP for TSS.

How do users experience core value proposition?

Store channels experience spread across Online, Offline stores and Market places but primarily 65% coming from D2C.

For D2C, entire experience is customization from Homepage/Category pages across App/Web and also CRM Journeys - be it Promotional, Retargeting or Transactional across Email, Push & WhatsApp channels.

To summarize, strong value offering with hyper personalization and being on top of current trends & strong brand machinery across designs/products & App/Web flows.

Natural frequency for product

Activation metric for users from TSS perspective would be purchase across any of the category

- Casual : 1 Order in span of 30 days

- Core : 2-3 Orders in span of 30 days

- Power : 3+ Orders in span of 30 days

Focus for TSS primarily is on repeatability of users ensuring they have decent bucket/ticket size.

Best Engagement Framework for the product

- Breadth in terms of different category products consumed, i.e, Men wear, women wear, kids wear and collections/accessories all visited and shopped would be a good engagement metric

- Frequency would be key metric for the user from engagement lens, i.e, more transaction done by unique user in X days and Y times would be critical to define their engagement level

- Depth is also a key metric for TSS as depth will highlight the transactional value associated with each spend/transaction happening

All engagement frameworks here would seem relevant for TSS but most important would be Depth for TSS as a product/platform

Here, Depth = f ( 3+ Orders in 30 Days, 2000+ per Transaction value) as AOV for average product is around 750-800.

Active user & frequency defined for cohort of users

Active user is the one who has done any transaction post Cart/Wishlist addition and has been successful, i.e., any purchase action which has been successful, this shows intent & activation for the user.

- Casual : 1 Order in span of X days

- Core : 2-3 Orders in span of X days

- Power : 3+ Orders in span of X days

Users who have done close to activation metric are considered secondary Active users ( Add to cart/Wishlist and PG page transaction done but failed) and push to convert them is incrementally higher via Sales, Offers, WhatsApp and multiple campaigns.

At TSS, there are 2 Active users cohort - Primary and Secondary but for entire case study, we will stick to primary user base.

ICP Segmentation:

Variables | ICP 1 | ICP 2 | ICP 3 |

Name | Jhanvi | Tanuj | Rehman |

Age | 19 | 26 | 34 |

Gender | Female | Male | Male |

City | Gurgaon | Mumbai | Hyderabad |

Agenda | New super heroes collection shopping | Hardik Pandya inspired collection | Shopping for his 6 year old Kid |

Education | Graduation from SVKM university | Tech Job in Mumbai | MBA from ISB Hyderabad |

Where do they spend their time at? (Online) | Instagram, WhatsApp, Twitter, Snapchat, Netflix, Apple TV, Music | LinkedIn, Twitter, Instagram, WhatsApp, Prime, Netflix, Music | WhatsApp, LinkedIn, News, Slack, Payment/Market related Apps |

Where do they spend their money at? (Online) | Food Apps, Shopping Apps | Travel apps, Food Apps | Travel Apps, Kids Books/shopping etc |

Where do they spend their time at? (Offline) | Travel, Food/Drinks, College & MBA Tuition majorly | Travel, Food/Drinks, Office majorly | Movies, Parks/Travelling inside/outside country, Religious places |

Where do they spend their money at? (Offline) | Shopping | Shopping | Shopping |

Feature they like the most on product? | Membership | Latest Collections tab/Discoverability of the product | Themes feature |

Frequency at which they use the product? | Weekly | Monthly once | Once in 6 months |

Time or Money spent on platform? | Money | Money | Money |

Segmentation/Cohort for TSS

RFM framework | Definition | Weightage |

Recency | Ordered product in last 30 days | 27% |

Frequency | Ordered product X times in last 30 days | 33% |

Monetary | Ordered products more than 2000 GMV in last order | 40% |

We would focus on RFM segmentation for The Souled Store and break them up into these buckets

Explanation for above model/image:

New customers are most recent, hence their recency score is high.

Champions and Loyal customers are good from all 3 parameters and have established Zen mode, need to track customer tickets, NPS, CSAT only for any alerts for them to move from Extreme power to risk/churn

Churned users mentioned here[Hibernating] are voluntary churn as it is due to other platform movement, category being out of stock or price sensitivity.

In terms of priority to solve these segments, we would need quick addressal for these cohorts:

- Best Customers[P0] - They have high Depth [Frequency X Monetary] but haven't transacted in Last 30 Days. Need to subtly reach out to these folks via our channel & also understand their App usage metrics

- At Risk [P1] - These are good users but based on our data science model, they would churn out very soon. Hence, very critical that we take action as these would be voluntary churn

- Need Attention [P2] - These are folks who are average performers but are sizable chunk [ Active last month and did decent order size with 1+ frequency]. Need to reengage and convert back

- New Customers & About to sleep [P3] - These are newly acquired customers (majorly organic) but need to keep reengaging them via multiple channels/tools

Campaign Structure For Engagement

Retention Design

User Cohort | March'23 (Monthly Active Users(L)) | March'23 Transactions (L) |

New | 0.18 | 0.21 |

|---|---|---|

Repeat | 0.55 | 1.11 |

Last Month New | 0.05 | 0.06 |

Last Month Repeat | 0.34 | 0.79 |

Last Month React | 0.17 | 0.26 |

React | 0.65 | 1.04 |

Dormant 1-2M | 0.12 | 0.22 |

Dormant 2-3M | 0.10 | 0.17 |

Dormant 3-6M | 0.16 | 0.25 |

Dormant 6+M | 0.17 | 0.25 |

Dormant 12+M | 0.11 | 0.15 |

Total | 1.38 | 2.35 |

User Cohort | New | Repeat | React | |

April'23 | M1 | 28% | 61% | 26% |

May'23 | M2 | 21% | 48% | 19% |

June'23 | M3 | 15% | 42% | 13% |

July'23 | M4 | 10% | 37% | 11% |

Aug'23 | M5 | 9% | 35% | 10% |

Sept'23 | M6 | 8% | 32% | 9% |

Oct'23 | M7 | 7% | 30% | 8% |

Nov'23 | M8 | 7% | 29% | 8% |

Dec'23 | M9 | 6% | 27% | 7% |

Jan'24 | M10 | 6% | 26% | 7% |

Feb'24 | M11 | 5% | 25% | 6% |

Mar'24 | M12 | 4% | 24% | 6% |

Overall Retention curve for TSS starts to flatten from M4 onwards and remains in similar range post that for overall cohort.

Retention Analysis

ICPs | Gender | Age | Objective of using product | M1 Retention Rates | Outliers/Learning |

ICP 1 | Female | 18-24 | Self | 52% | - |

ICP 2 | Male | 18-24 | Self | 39% | - |

ICP 3 | Female | 24-35 | Self/Family/Relatives | 47% | Appetitie to pay/Flexibility |

ICP 4 | Male | 24-35 | Self/Family/Relatives | 41% | Appetitie to pay/Flexibility |

ICP 5 | Female | 35+ | Kids | 27% | - |

ICP 6 | Male | 35+ | Kids | 18% | - |

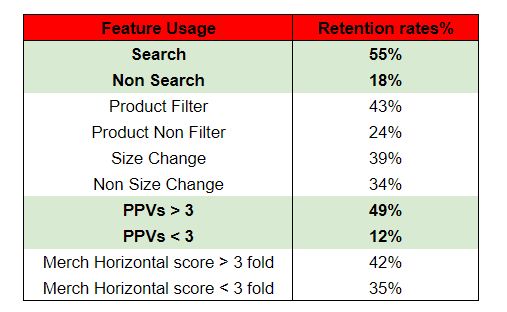

Search usage and Product page views more than 3 are critical aspects/feature to understand forward retention rates for any user cohort (new, repeat, react & overall).

Top Reasons for Churn

Top metrics to track for respective churn use case

- SLA/TAT/Delivery Timeline breached: Customer tickets, Help line support number calls quantum, Ratings/Reviews on product delivery, App store rating, Social media escalations and CES score

- Damaged product delivered: CSAT, customer tickets, ratings/reviews for the product purchased

- Out of stock concerns: NPS, App store rating

- Poor product Quality: NPS, CSAT, Ratings/reviews for product

- Higher Prices: CSAT

Also, other critical metrics to gauge/track and initiate churn resolution campaigns/initiatives would be:

- App uninstallation

- Un-subscription of Emails/WhatsApp

- Social media comments tagging TSS

Resurrection campaigns

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.